CONNECTICUT

Home Sales Up, Average Price Up

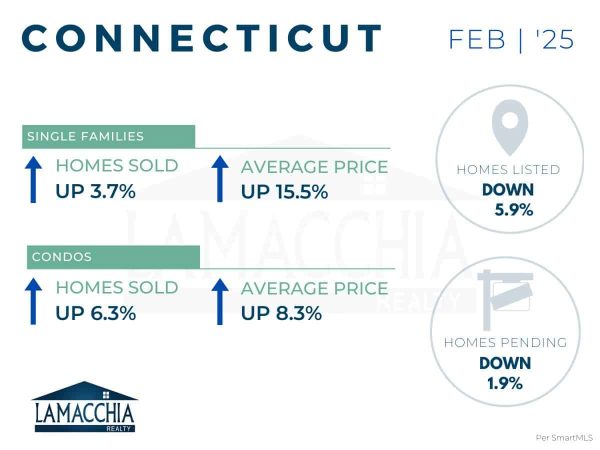

Home sales are up 4.4% year over year, with February 2025 at 1,903 compared to 1,823 last February. Sales are up across all categories

- Single families: 1,361 (2024) | 1,421 (2025)

- Condominiums: 462 (2024) | 491 (2025)

The average sale price has increased by 14.1% compared to last year, now at $540,133 from $473,467. Prices increased for all categories.

- Single families: $528,453 (2024) | $610,620 (2025)

- Condominiums: $311,482 (2024) | $337,429 (2023)

Homes Listed For Sale:

The number of homes listed is down by 5.9% when compared to February 2024.

- 2025: 2,513

- 2024: 2,670

- 2023: 2,575

Pending Home Sales:

The number of homes placed under contract is down by 1.9% when compared to February 2024.

- 2025: 2,148

- 2024: 2,189

- 2023: 2,291

Data provided by SmartMLS then compared to the prior year.

What’s Happening in the Market?

- In February 2025, national home sales decreased 1.2% compared to a year ago, Despite this trend, Connecticut saw an increase of 4.4% in Home sales.

- According to Mortgage News Daily, March mortgage rates started in the high 6% range, around 6.7% to 6.8%, and have held steady throughout the month.

- Year-over-year trends show a decrease in new listings and pending sales, possibly due to winter conditions or the leap year in 2024. However, spring is around the corner, and many sellers and buyers are preparing for the season. Sellers, here’s why listing your home this spring could work to your advantage.

- When compared to last year, the average sales price for homes has increased. However, it’s still crucial to price your home competitively. Doing so will help generate greater buyer interest and potentially lead to higher offers. Here is a guide on what to keep in mind when pricing a home.

- Buyers, as spring approaches, expect a surge in new inventory hitting the market. With more options available, it’s essential to be prepared. Here are 8 key steps to take before purchasing your first home to make sure you’re ready for the journey ahead.